This content may have passed its compliance expiration date.

Please email Info@RealWealthMarketing.com for more information on availability.

Buy Access to this Webinar

Become a memberIf you’re not already Top of the Table, the ideas from this 1 hour session will get you there. Top of the Table Advisor Jim Silbernagel, CFP®, LUTCF presents:

- Large Life Insurance Sales Opportunities

- How to Create Assets for You to Manage

- Tax-Free Roth Conversion Strategies

- How to Create Tax Deductions for Your Clients

- How to Help Your Clients Make an Impact with Their Favorite Charity

- How to Avoid Capital Gains Tax

Contact Real Wealth® Tax & Accounting with questions or to get a quote for their services:

- Email nnarveson@rwtax.net

- Call (262) 626-2088

- Visit rwtax.net

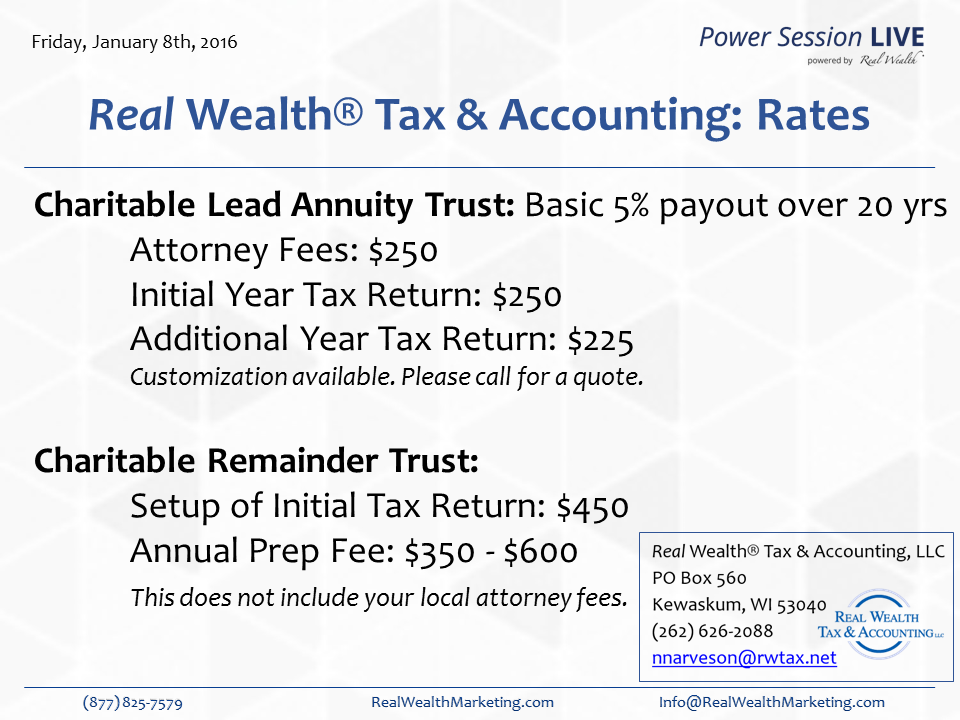

- Rates:

What Advisors Think of this Session

| Topic Rating | |

| Presenter(s) Rating | |

|

Average

|

|

“Valuable enough to take a CPA/attorney partner to lunch and discuss.” – Jim Pulley

“Great education on using trusts to create more value for clients.” – Steve Hennessy

“Great, actionable ideas with implementation support.” – John Hutchinson

“Great to learn about strategies to help alleviate taxes.” – Andrew Chymych

“Interesting new topic.” – Daniel Flees

“Concepts aren’t new to me but the repetition helps with the grasp of the information and my confidence with the topic/material.” – Jim Gano

“Loved the Roth conversion idea.” – John Butler

“Great to hear how CRUTs and CLTs work.” – Douglas Bird

“Valuable to see how you can use [CRTs] with normal individuals that don’t have to have a worth of $100 million.” – JC LeBlanc

“Learned how to offer value with the CRUT.” – Theresa White

“New conceptual sales opportunities.” – Anthony D’Amico

“Very useful tools presented.” – Craig Martin

“Motivating session.” – David Wilgan

“Great info on the CRAT.” – Gary Pelfrey

“Valuable to see how you can use the CRT to get the deduction and then convert the IRA to Roth.” – Tyler Adams.

“The slides really helped.” – Michael Abbate

“You definitely “wet our appetite” for what is possible using the 2 different trusts covered. Great overview in a very short period of time. Taxation issues can be very intimidating, and I realize how much I still have to learn. Thanks for helping me learn more. Love the idea of anything applying to our “middle America” client base.” – Dan Carr

“Presenter’s knowledge and delivery are excellent, in addition to offering a program to implement the strategies.” – Thomas Fay

“A topic that I haven’t had exposure to, and yet is appropriate for middle America.” – Mark Rogers

“Loved hearing of more options for clients.” – Katherine Brown

“New ideas and the flow charts to easily show it.” – Thomas Pyle

“The concepts were new to me. I especially liked the Roth conversion ideas.” – Tim Preston

“Great info on the CRT and CLT.” – Chuck Driskell

“Great new infomation.” – Carl Walbert

“Got more knowledge on trusts and taxes.” – Tim Johnson

“Appreciated concepts and out of box thinking.” – Christine McDonald

“Learned how CRTs and CLTs could be used with clients.” – Daniel Barizo

“I was not aware of CLTs and how they fit into the market place. I appreciated learning more about that charitable giving process while benefiting from tax deductions.” – Jennifer Schell

“The information provided is a HUGE benefit to our clients…most valuable information was to be a part of the process! Don’t send your client to a competitor that can replace you!” – James Moore

“Clearly explained but not too long. Very valuable info for the mass-affluent many of us serve. Would really like to see more topics and strategies applicable to middle market clients.” – Zach Youngblood

“The “re-introduction” of the the CRUT and the others Jim went over that I had essentially put on the back shelf and out of my tool box. Your webinar topics are all great. Keep up the good work!” – Charles Stickney

“Good quick review.” – Jeff Snyder

“Great CRT and CLT info.” – David Miller

“Though limited opportunities, the Charitable process could truly provide some great servicing to clients.” – Ryan Greene

“Loved the tax information and the DOL update.” – Gary Lykken

“The unique and detailed expertise and insight was great!!!” – John Weeks

“Valuable information on trusts and funding.” – Mark Mallon

“Got some great ideas to consider.” – Mike Kleen

“Great session – keeping fresh and old ideas in our heads for planning.” – David Anderson

“Loved the tips on recognizing opportunities and how to differentiate yourself.” – David Malkin

“High level tax planning ideas and resources to put them into play. DOL Update was great.” – Karen Boykin

“Presenter was great – sharing of his knowledge and examples.” – Mary Chitwood

“Tax law changes and strategies for clients to consider were invaluable. Jim, great job today as always. You were subtly touching on many topics near and dear to my heart and those of my high net worth investors, like self-directed IRA and alternative investments, both of which work well in the charitable strategies and tax planning strategies you talked about today.” – Ryan Parson

“All items were new to me!” – Keith Vukusich

“Well organized with new tax ideas laced with a charitable giving intent.” – Andy Dinger

“Great Case Studies and the Attorney/CPA rates stated. I just started attending and look forward to future topics!” – Tom Jacobson

“Great ideas on planting seeds.” – Terry Jordan

“All of it was great!” – Lawrence Kelly

“Great presentation on taking an idea that is used for the wealthy and showing the application to the middle market.” – Steve Fisher

“Info was timely, and presented in a concise professional manner.” – Richard Lazarski

“Thanks for the Charitable Planning details and process. Got better understanding of why CPA and Attorney Fees can be so high for these trusts.” – Darrell Doi

“The slides on CRTs & CLTs were great.” – John Weiss

“Learned about the use of trusts in planning. You’re doing a great job.” – Tim Louzy

“Really sharp ideas on charitable strategies in two specific markets that are straightforward.” – Steven Oriol

“CRTs and CLAT are important tax efficient efficiency strategies” – Norbert Ruiz

“It was all good.” – Grant Thompson

“Introducing a lesser known avenue for client’s wanting to donate to charities.” – Gurdayal Singh

“I learned a new concept that may help many people in my community. A lot of farm families where I am at, which could benefit. Now I just need to educate myself greater on what was presented.” -Douglas Fitzpatrick

“Ideas are applicable to many situations.” – Albert Kirchner

“Loved that the topic was applied to the middle market.” – Leon Avila

“Presenter was very knowledgeable about the subject matter.” – Joe Trevino

“Valuable to see the positioning of CRT vs CLT for charitable minded clients.” – Mark DeGrave

“Thanks for the new updates.” – Bernadette Collins

“Great, conceptual ideas; don’t normally think about charitable strategies at lower income markets.” – Greg Purvis

“Learned concepts I’ll be sure to consider. I’ve been pleased with your webinar topics and presenters. Thank you.” -Garth Hassel

“I am a charitable gift planner and always enjoy hearing from financial planners on techniques they employ. But aside from charitable strategies, I was also struck by the concept of doing Roth IRA conversions to help use up charitable deductions, which would otherwise have to be carried forward. Great idea for the donor.” – Ron Blaum

“The whole concept is new to me.” – Andrea Robinson

“Unique approach with clients, to Current Tax changes and segue to Annuities and Roth IRA’s.” – Joe Anthes

“Great concepts introduced at 90 MPH. Keep the planning ideas to improve client outcome coming.” – Ronald Scarborough

“Great info that I can apply to my practice.” – Juliann Smith

“The presenter was great.” – Rosana bowman

“Got more clarification and ideas on mid-income charitable giving and tax saving concepts. It also hit one of my markets—mid size farm families. I’m looking forward to some of the future topics/concepts that were shown.” – Bob Gerber

“Complex material, simplified.” – William RYan

“The slides were valuable.” – Kevin White

“It is an innovative tax solution.” – Ben Hussong

“Great Charitable Trust examples.” – Megan McGinty

“The charitable information was very interesting and educational. Everything has been beneficial. I appreciate the webinars and love that they are not company specific. Great information.” – Sandra Bailey

“Valuable tax advantages.” – Keith Wood